Bitcoin Wavers at $62K Amid Major Swings in Stocks, Gold; Memecoins Falter as Profit-Taking Sets In

Cryptocurrencies belied their reputation for volatility, as they didn’t seem to react to the large moves in major traditional assets on Tuesday.

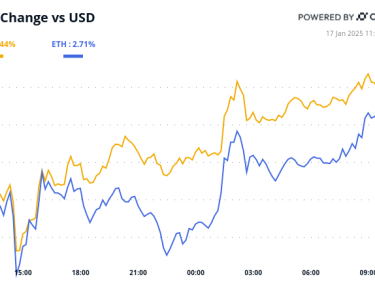

Bitcoin (BTC) continued to tread water slightly above $62,000, with each drop below that price level quickly reversing but otherwise trading aimlessly. It was down 1.2% over the past 24 hours, in-line with the broad-market benchmark CoinDesk 20 Index’s performance. Ethereum’s ether (ETH) was nearly flat during the same period, while layer-1 blockchain Aptos’s native token (APT) stood out with a 6% gain.

Memecoins, perhaps the riskiest corner of the crypto space, sold off as traders took some profits off the table after the past few days’ surge. Large-cap meme tokens pepe (PEPE), dogwifhat WIF and popcat declined roughly 5% during the day.

That’s a lackluster showing on a day when U.S. stocks rallied, with the tech-heavy Nasdaq climbing 1.5%. Traditional risk-off haven gold sold off 1.5%, with crude oil and silver both tumbling 4% after their run over the past few weeks. The cause behind the risk of action might be easing concerns about spiraling escalation in the Middle East after a Hezbollah leader reportedly supported efforts for a potential ceasefire with Israel.

“It feels like there is less mental bandwidth for traditional finance players to think about crypto given the preponderance of macro narratives and tradable opportunities around Israel/Iran, China stimulus, the Fed cuts, and Trump election odds,” Joshua Lim, co-founder of crypto trading firm Arbelos Markets, said in a Telegram message.

“Crypto volumes and volatility have languished while the crypto-native community itself has increasingly rotated into short-lived memecoin narratives and away from majors,” he added.

Crypto investors who overwhelmingly anticipated October to be a bullish month have been disappointed with prices down to flat for the month so far.

Zooming out to a longer timeframe, bitcoin is just consolidating below its all-time record, building a launchpad to much higher prices next year, well-followed trader Bob Loukas said.

“An 8 month base has been built, sentiment reset, and rates are easing,” Loukas said in an X post. “Bitcoin closes the second year of the four-year cycle next month, entering the third and historically explosive year.”

BTC’s all-time high this March was well ahead of past market cycle patterns, Crypto trader CryptoCon noted, so it’s reasonable that it takes more time to digest the move and build out the market structure.

“We are still ahead of all other cycles. 2012 and 2016 wouldn’t see new all-time highs for another 5-6 months,” CryptoCon said in an X post. “Perspective is key; Bitcoin is doing great.”