In today’s issue, Marissa Kim from Abra Capital Management looks at the growth of treasuries adopting bitcoin as a reserve asset.

Then, Peter Gaffney shares his recent experience and conversations from the Cboe RMC conference in Ask an Expert.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

With U.S. Senator Cynthia Lummis introducing a groundbreaking bill that would direct the Treasury Department to purchase 1 billion bitcoins over the next five years, bitcoin is moving into the realm of legitimacy as a reserve asset. If the U.S. government is willing to consider bitcoin for its reserves, it stands to reason that corporations should follow suit. Interestingly, the corporate world is already ahead of the curve. In this current cycle of Bitcoin’s institutionalization and broader adoption, even non-crypto-native companies are starting to recognize the strategic value of holding bitcoin as a treasury asset, and for a variety of different reasons.

Historically, only crypto-native companies held bitcoin on their balance sheets. However, a significant structural shift has occurred over the past four years. Public and private companies are now embracing bitcoin, motivated by economic, geopolitical, and regulatory factors. For instance, public and private companies currently hold over 4% of all bitcoin, valued at around $50 billion, with MicroStrategy leading the way, having accumulated a bitcoin portfolio worth $13 billion since August 2020.

There are compelling reasons behind this shift. Many firms are turning to bitcoin as a treasury reserve asset due to its potential as a reliable store of value, especially in comparison to the U.S. dollar. Since the Federal Reserve took control of U.S. finances in 1913, the dollar has seen significant devaluation – a trend exacerbated by the COVID-19 pandemic. Traditional treasury assets like cash, bonds or cash equivalents are depreciating, unable to keep pace with inflation or the constant printing of dollars. Markets traditionally discount cash on balance sheets to zero, viewing it as a depreciating asset. However, by replacing cash with an appreciating asset like bitcoin, companies can achieve a more positive evaluation of their balance sheets. This strategic move has already led to significant increases in stock prices, as demonstrated by MicroStrategy’s success.

Unlike gold, bitcoin has zero long-term dilution due to its fixed supply cap of 21 million coins, enforced by a distributed node network. This lack of dilution makes bitcoin a powerful savings asset, especially for corporations looking to preserve value over time. In contrast, gold’s annual dilution rate leads to underperformance compared to major equity indices, making it less attractive for corporate savings.

However, companies considering adding bitcoin to their balance sheets should be aware of certain risks. Volatility remains a significant concern. Bitcoin is still in its growth and adoption phase, and its price can fluctuate dramatically. This volatility makes bitcoin more suitable as a long-term savings asset, ideally for periods of four years or more, rather than for short-term holdings. Companies must also be prepared for substantial price swings, which can impact their financial statements.

To manage these risks, many companies take a cautious approach by only allocating a portion of their treasury to bitcoin. This strategy allows them to benefit from Bitcoin’s potential growth while limiting their exposure to its volatility. By diversifying their treasury holdings, companies can balance potential returns with the risk of price fluctuations, ensuring they are not overly reliant on a single asset.

Beyond its economic appeal, Bitcoin is also viewed as a safeguard against geopolitical uncertainty. In an era of heightened inflation fueled by global conflicts and political uncertainties, bitcoin’s hard-coded inflation rate and independence from central bank policies provide a unique form of financial security. Its liquidity makes it easily convertible to cash when needed, adding to its attractiveness as a versatile treasury asset.

The adoption of Bitcoin is not limited to any single type of company. Different non-crypto-native firms are now utilizing Bitcoin in diverse ways. Family offices are integrating Bitcoin and other cryptocurrencies into their treasury strategies to generate yield, borrow against holdings and preserve long-term wealth. Small and medium-size businesses, including real estate developers, most notably, are using bitcoin as collateral to secure loans for business or property projects. Non-profits are also increasingly turning to bitcoin to maximize donations and ensure the longevity of their stated missions.

As the U.S. government considers adding bitcoin to its treasury reserves, a broad range of businesses are already taking proactive steps to incorporate digital assets into their financial strategies. As bitcoin continues to gain acceptance as a treasury reserve asset, we can expect even more widespread corporate adoption across a range of industries, paving the way for a new era of financial freedom.

– Marissa Kim, head of Asset Management, Abra Capital Management

Q. What were some of the emerging product themes you are seeing?

A. Yield products within ETF wrappers had quite the buzz around them. Talking points surrounded the ability to provide income to investors via multiple covered call strategies varying from daily to monthly options, the added capability for active management to capture an extra portion of the right tail in investment growth alongside income, and the sophistication of individual investors and traders these days versus previous decades. With the rate environment remaining at a relatively high point thus far in the 2020s and new retirees growing, advisors and money managers seem to be placing a larger emphasis on longer-term and sometimes niche income-generating strategies.

Q. Where do Digital Assets play a role?

Digital Assets are still primarily placed in two buckets: 1) as a macro hedge or standardized global currency and 2) as the powering currencies behind the newest financial operating system. Opinions as to which crypto assets correspond to which certainly vary, although consensus is that most see the impending decision to allocate at least a very small portion of client assets to one or a few of the blue-chip cryptocurrencies.

Q. Why should we be paying attention to real-world asset trends?

A. The reality is that portfolio management is ever-moving towards digital experiences. The end goal of a single compliant and secure custodial solution or interface to manage cryptocurrency investments, cash positions, treasuries, agency securities, alternatives, ETFs and other bedrock asset classes in one place is in sight due to the advancements in tokenization. Asset aggregation is a key theme across incumbent and startup service providers alike, displaying and enabling access to the aforementioned product types in a one-stop-shop manner.

The opinions in the Ask an Expert column are solely of the author’s and are not representative of Blue Water Financial Technologies Services LLC Disclosure

– Peter Gaffney, Vice President, Business Development & Strategy, Blue Water Financial Technologies Services, LLC.

Stripe acquired Bridge, a stablecoin platform, for $1 billion.

The amount of ETH held in wallets has increased by 65% since the beginning of 2024.

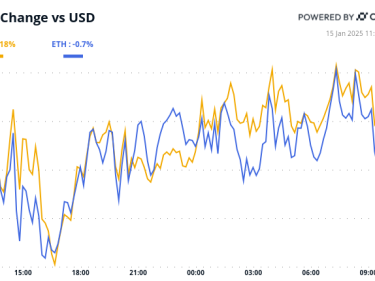

The bitcoin price climbed towards $70,000 this week.