Bitcoin started the week with a 3% decline, falling below $58,400. The drop came ahead of expectations of the U.S. Federal Reserve potentially cutting rates, influencing market sentiment.

U.S.-listed Bitcoin ETFs saw significant inflows on Friday at over $263 million in the highest since July 22.

Ether ETFs also saw inflows, though much smaller at $1.5 million, indicating continued investor interest in crypto assets.

Bitcoin (BTC) began the trading week down 3%, trading below $58,400, as the CoinDesk 20, a measure of the largest digital assets, was down 5%.

BTC spent much of the weekend over $60,000 after favorable U.S. data fueled a rise late Friday. BTC exchange-traded funds (ETFs) listed in the U.S. recorded over $263 million in net inflows – the highest since July 22 – while ether ETFs recorded their second day of inflows since August 28 at $1.5 million.

However, crypto markets slumped Monday as Asian exchanges opened for trading ahead of a key week where traders worldwide expect the Federal Reserve to make its first rate cuts in over four years.

Polymarket bettors are giving it a 51% chance of a 50 basis points cut and a 48% chance of a 25 basis point cut, while only a 2% chance of no change.

A pivot to lower borrowing costs has historically buoyed bullish sentiment among traders as cheap access to money spurts growth in riskier sectors.

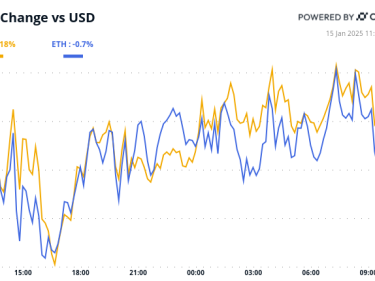

Ether (ETH) led losses among majors with a 5.5% drop over the past 24 hours, per CoinGecko data, to mark its worst one-day slide since early August. Cardano’s ADA fell 5%, Solana’s SOL lost 4%, while BNB Chain’s BNB emerged as the best performer with a 1.1% loss.

Nervos’ CKB was one of the few movers in the green with a 10.5% jump in the last 24 hours on continued positive sentiment after Korean exchange Upbit – where traders have a strong taste for memecoins – listed the token.

Futures traders betting on higher prices lost over $143 million amid the sudden drop, CoinGlass data shows.

Elsewhere, the widely-watched BTC/ETH ratio, which tracks the relative movement of the two largest tokens, fell to four-year lows.

Ethereum as a protocol has had some serious competition in the last year, as Solana looks to be the destination of choice to launch memecoins, and new chains like Base and Telegram-affiliated (TON) capture more mindshare – which has likely impacted demand for ETH.

Sony’s Soneium may also provide some competition as it continues to be built out. Sony and Circle announced today that USDC would be offered on the chain. Absent from the announcement was precisely how much would be issued.

UPDATE (Sept. 16, 14:40 UTC): Rewrites headline to focus on Fed action