This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 1,961 +3.6% Bitcoin (BTC): $60,680 +5.8% Ether (ETC): $2,636 +7.7% S&P 500: 5,319.31 +2.3% Gold: $2,468 +1.9% Nikkei 225: 35,025 +0.56%

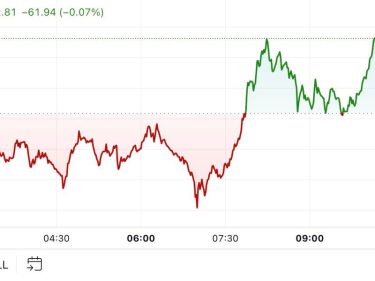

Bitcoin briefly returned to $62,000 during the Asian morning as the crypto market extended its recovery from the rout at the start of the week. BTC subsequently dropped to trade just above $60,500, over 5.5% higher than 24 hours ago. The CoinDesk 20 Index (CD20) has risen by around 3.9%, with ether the biggest gainer, up almost 7.75% at $2,540. Crypto assets are mirroring the U.S. stock market, which is similarly recovering from Monday’s slump. The S&P 500 had its best day since November 2022 on Thursday while the Nasdaq 100 rose 3.1%.

BTC’s rally in the latter part of this week has seen nearly $100 million in shorts liquidated, with some analysts saying bitcoin’s dramatic slumps are now behind it. With the Bank of Japan’s indication that it will not raise interest rates further and selling pressure from Jump Trading drying up, BTC is unlikely to drop below $50,000, according to Transform Ventures founder Michael Terpin. “Regardless of the next 60 days, the bull market will continue along traditional four-year cycle lines with solid gains in October and November,” he added. Terpin also repeated the position of many analysts that a Donald Trump win in November’s presidential election could see BTC surge to over $100,000.

Ionic Digital, the bitcoin miner that bought bankrupt crypto lender Celsius’ mining assets, has delayed a plan to go public after losing its CEO and auditor. Former CEO Matt Prusak told the company in July he won’t stay on after the end of his employment term on Aug. 14, the miner said in a statement Thursday. Ionic has started searching for a new CEO and named its recently hired CFO, John Penver, the interim boss. Penver was hired in July to shepherd the company’s plan to go public. Ionic said that despite the leadership change, it still intends to conduct an initial public offering and is “confident” Penver will be able to lead the company to that goal.

The chart shows bitcoin’s short-term and long-term skews, measuring the price differential between call and put options.

Seven-day and one-month skews hold below zero, signaling persistent demand for protective puts in the wake of Thursday’s 12% price surge.

It’s a sign traders remain fearful of a price swoon.

Source: Amberdata

– Omkar Godbole