This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

CoinDesk 20 Index: 1,908.58 +1.34%

Bitcoin (BTC): $61,001.69 -0.04%

Ether (ETH): $2,410.36 +0.74%

S&P 500: 5,780.05 -0.21%

Gold: $2,640.19 +0.28%

Nikkei 225: 39,605.80 +0.57%

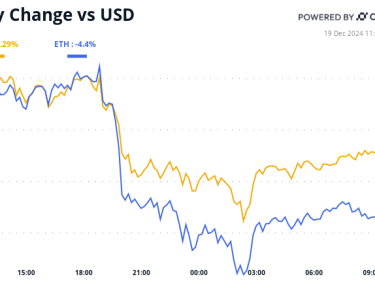

Following its 4% slide during U.S. hours on Thursday, bitcoin regained some ground to trade above $61,000 on Friday. BTC fell to $59,000 following a U.S. CPI report that showed hotter-than-expected inflation in September, seemingly putting paid to hopes of another 50 basis-point interest-rate cut by the Fed next month. The bounce left BTC about 0.25% higher than 24 hours ago. The broader digital asset market showed stronger gains of 1.65%, as measured by the CoinDesk 20 Index. XRP and DOGE led the way, adding around 2.5% and 2% respectively.

Donald Trump’s odds of a return to the White House surged to a more than two-month high on Polymarket. Traders are giving the former president a 55.8% shot versus Vice President Kamala Harris’ 43.8% on the prediction market site, where more than $1.6 billion has been wagered on the November election. Trump’s chances have risen to levels last seen days after President Joe Biden said he wouldn’t seek reelection, clearing the way for Harris to take over. Another prediction market, Kalshi, which just recently won permission to list contracts based on U.S. elections, also shows Trump in the lead over Harris: 52% to 48%.

Crypto exchange Bitnomial filed suit against the SEC, saying the regulator overextended its jurisdiction in seeking to regulate a proposed XRP futures contract together with the CFTC. In a Thursday filing with the U.S. District Court for the Northern District of Illinois, the company said the futures fall solely in the CFTC’s remit and the SEC’s involvement would add significantly to the company’s regulatory burden. The exchange self-certified that the XRP futures did not violate the CFTC’s regulations on Aug. 9, it said. “Bitnomial disagrees with the SEC’s view that XRP is an investment contract and, therefore, a security, and that XRP Futures are thus security futures,” it said in the filing.

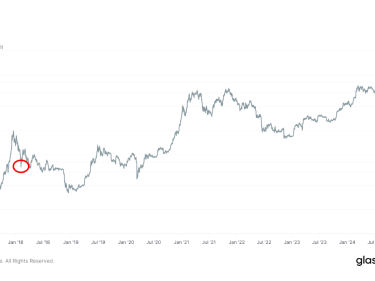

The chart shows bitcoin’s price performance months after 2012, 2016 and 2020 U.S. presidential elections.

Bitcoin has seen an average gain of over 4,000% in 400 days after elections.

“Past U.S. election events have aligned well with both Bitcoin Halving events and U.S. business cycle troughs, which are likely the main factors behind Bitcoin’s stellar performance over the past 3 election cycles in 2012, 2016 and 2020. We have a similar alignment in this cycle,” analysts at ETC Group said in a report.

Source: ETC Group, Bitwise

– Omkar Godbole