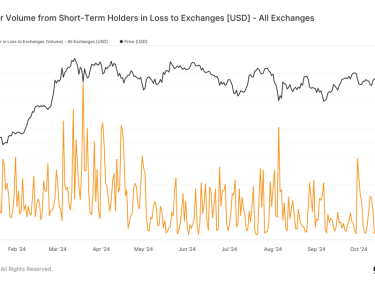

The Hong Kong-listed spot crypto ETFs saw huge outflows on Monday, data from Farside Investors shows.

Investors pulled nearly $40 million out of the six spot bitcoin and ether ETFs on the first day of the week.

The Hong Kong-listed spot bitcoin and ether exchange-traded funds (ETFs) saw heavy outflows on Monday following bitcoin’s drop below $61,000 on Friday.

The spot bitcoin ETFs from issuers ChinaAMC, Harvest Global, as well as Bosera and Hashkey, saw a combined $32.7 million outflows on Monday, according to data from Farside Investors. This number is significantly higher than previous outflows, which hovered around the $6 million mark.

The spot ether ETFs saw $6.6 million in outflows which is also significantly higher than past numbers.

After eight days of trading, investors pulled roughly $13 million out of the six ETFs, a disappointing result for the Asia-based ETFs when compared to the initial excitement phase around its U.S.-listed counterparts.

Many industry enthusiasts have pointed out that the overall Hong Kong-based ETF market is relatively small, with about $50 billion in assets. In comparison, the ETF market in the U.S. is estimated at approximately $9 trillion in assets under management.

Some rumors suggested that mainland Chinese investors had gained access to the funds via Stock Connect, which would open the gates for a far bigger investor base, but Hong Kong’s stock exchange told CoinDesk earlier on Monday that that rumor was false.