HKEX said the index will provide investors with transparent and reliable benchmarks for Bitcoin and Ether pricing in the Asian time zone.

The company’s CEO said it would “reinforce Hong Kong’s role as an international financial center”.

Hong Kong Exchanges and Clearing (HKEX) will launch a virtual asset index series on Nov. 15, the company announced on Monday.

“By offering transparent and reliable real-time benchmarks, we seek to enable investors to make informed investment decisions, which will in turn support the development of the virtual asset ecosystem and reinforce Hong Kong’s role as an international financial center,” said HKEX CEO, Bonnie Y Chan.

The index will be administered and calculated by CCData, a UK-registered benchmark administrator and virtual asset data and index provider. CCData is owned by CoinDesk.

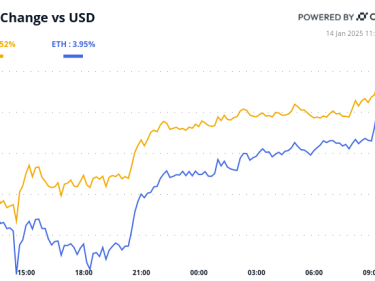

The reference index is a 24-hour volume weighted reference spot price of bitcoin or ether, using prices aggregated from top-rated virtual asset exchanges. It will be calculated in real-time and denominated in U.S. dollars.

The reference rate is designed for the settlement of financial products, calculated daily at 4:00 pm Hong Kong time.