The positive catalysts to drive the price of bitcoin and the broader crypto market are already factored in, said JPMorgan in a note.

The positioning in the BTC futures market and macro concerns are keeping the bank cautious on digital assets.

The catalysts that could drive the price of bitcoin (BTC) and broader cryptocurrency markets higher are mostly factored in, said banking giant JPMorgan.

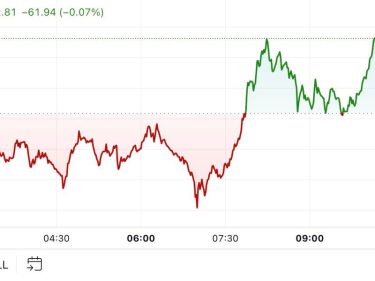

Digital assets prices saw their biggest selloff since the 2022 FTX implosion earlier this week, mostly driven by contagion in traditional markets, with bitcoin falling more than 15% before rebounding somewhat, the bank’s analysts wrote. The selloff in crypto was mostly driven by retail investors, while momentum traders also contributed by exiting their long positions and building shorts, the bank said.

The swift correction started after the Bank of Japan raised its benchmark interest rate last week, leading to a stronger yen and the unwinding of the “carry trade” – a strategy in which traders borrowed money in the low interest rate yen to speculate in higher-yielding assets. While both traditional and digital asset markets have since stabilized, many traders remain concerned.

Meanwhile, there has been limited to no “de-risking” from the institutional investors in the bitcoin futures market, which shows limited open interest and sideways action over the spot price spread, the analysts said.

The JPMorgan team noted that there are few catalysts that could keep institutional investors optimistic on bitcoin and crypto sector, including Morgan Stanley wealth advisors offering crypto to their clients, bankruptcy paybacks being almost over, and both political parties in the U.S. pointing towards favorable regulations.

However, those positive catalysts seem already priced into the current price of digital assets, the bank said. “With limited de-risking in the CME bitcoin futures space and with equity markets still looking vulnerable … we remain cautious on crypto market despite the recent correction.”

The cautious note from JPMorgan isn’t new, as the bank has recently said that any rebound in crypto markets in the near term is likely to be short-lived as bitcoin price is still too high relative to its production cost and versus gold.

The bank’s analysts currently estimate that the average production cost for mining bitcoin is around $49,000, and any price action below this level would pressure the miners, weighing further on BTC price.