This week in prediction markets…

Will there be a Biden-Trump-Kennedy debate?

When will OpenAI’s Sora launch?

It’s gone to the cats

Solana vs. Ethereum: Which chain will earn more in fees?

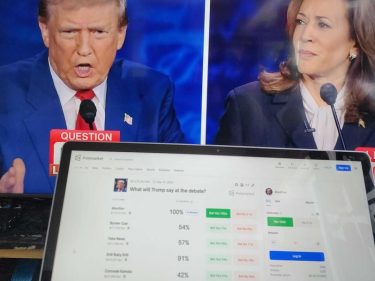

A presidential debate that includes independent candidate Robert F. Kennedy Jr. alongside President Biden or Republican frontrunner Donald Trump is unlikely to happen, bettors on crypto-based predictions platform Polymarket are signaling.

“Yes” shares in the contract are trading at 27 cents, meaning the market sees a 27% chance of it occurring. Each share pays out $1 if the prediction comes true, and zero if not.

The machinations of the American political-industrial complex make it difficult for a third party, or independent candidate, to succeed. Ballot access laws favor major parties, creating significant barriers for third-party candidates. Getting on a debate stage has another high threshold of its own.

Rules for the first debate, scheduled for June 27 on CNN, say that the candidates must appear on enough state ballots to hypothetically reach 270 electoral votes, and also receive 15% in four polls. A second debate on ABC is scheduled for September, and it also has a 15% polling rule.

Currently, RFK Jr. is polling at just under 10% in national polls compiled by 270toWin. Right now his team says they have confirmed ballot access, or are working on it, in enough states to win 201 electoral votes, which is enough to be a spoiler, but not to win the presidency.

But independent candidates have participated in the debates in living memory: in 1992, independent candidate H. Ross Perot appeared on stage alongside George H.W. Bush and Bill Clinton.

To be clear, the Polymarket contract says that RFK Jr. must participate in a debate including Trump or Biden. It doesn’t say that the debate must be an official one.

Trump’s campaign wants more debates, according to reports, proposing one per month from June to September, preferring two-hour stand-up debates in larger venues with live audiences.

The current train of thought holds that RFK Jr.’s campaign is more of a threat to Biden than Trump’s, and polls that include him give Trump a slight edge, up to 5 points in some.

It’s plausible that the Trump campaign could decide to host a streaming debate with the Kennedy campaign, or hold it on a lesser-known network like OANN. It just needs to be a “publicly broadcast debate” per Polymarket’s rules.

(Don’t forget that Kennedy is coming to CoinDesk’s Consensus conference, taking the stage on May 31 at 4:30 PM)

Sora, OpenAI’s text-to-video generator, wowed the world when Sam Altman’s company demoed the project back in February.

Missing is a launch date.

Bettors on Kalshi, a U.S.-regulated platform, are predicting that launch will take place sometime between September and the end of 2025, with only a 27% chance it will occur before September.

But there’s one thing that’s getting in the way of a wide release of Sora: the availability of high-end graphics processing units (GPUs). Rendering video from text prompts is going to take a lot of them, more, in fact, than many of the world’s largest customers of Nvidia have in their data centers.

According to a report by Factorial Funds, OpenAI’s Sora faces significant challenges regarding GPU availability, as mainstream adoption of text-to-video generation would require hundreds of thousands of server-grade GPUs at a cost of tens of billions.

Factorial estimates that supporting the creator community of platforms like TikTok and YouTube alone would necessitate around 720,000 Nvidia H100 GPUs, far exceeding the combined resources of major tech companies like Microsoft, Meta, and Google.

But remember, the contract isn’t asking if Sora will be widely available. A launch with limited availability and a high monthly cost would still count. It’s just asking if it will launch.

Punters on Polymarket aren’t expecting any of the best-known cat meme coins to become the first such token to reach the $1 billion market cap milestone.

A market capitalization bet for cat-themed tokens, which some expect to flip their dog-themed counterparts in the next bull cycle, has racked up $1.2 million in bets since going live in March. As of Monday, popular tokens Popcat (POPCAT) and cat in a dogs world (MEW) have 22% and 7% odds, while shark cat (SC) and toshi (TOSHI) have odds of under 2%.

Despite all these memes being valued at over $200 million and occupying massive mindshare in the meme coin community, punters aren’t expecting any of these to become the first billion-dollar cat meme.

Instead, the “others/none in 2024” category dominates the odds at 68%. Other cat-themed tokens in the open market but not referenced in the Polymarket contract are mog (MOG), wen (WEN) and maneki (MANEKI), according to CoinGecko.

The high odds for two distinct outcomes suggest traders either expect a whole other cat meme to become the biggest or expect no single token in the category to get such a rich valuation.

The apparent bearish sentiment is likely not due to the lack of buying pressure, either. Two dog tokens, bonk (BONK), dogwifhat (WIF), and the frog-themed pepe (PEPE), were launched in 2023 and zoomed to over $3 billion each in less than a year, showcasing the demand for such tokens.

Among meme coin hunters, the perceived cuteness of a meme drives its virality and, ultimately, price. So which is cuter: a dog with a pink beanie hat or a cat with a mouth that pops? The punters have decided.

A market betting on Solana fees flipping those of Ethereum has fallen 12 points in the past week, after jumping up to 35% earlier in the month.

The “Solana flips ETH in daily fees in May?” market, which has seen over $60,000 in wagers placed, is a market on whether the daily fees of Solana (SOL) will surpass that of Ethereum (ETH) for any day within this market’s time frame from May 10 to May 31.

Odds of the flip rose earlier this month due to a revival of meme coin trading as GameStop stock prices surged higher, aiding growth in meme tokens.

However, the odds fell following a $2 million exploit on Pump.Fun, a tool that lets anyone deploy a tradeable token on Solana. The brief exploit may have been expected by some to slow the rapid issuance of meme coins on Solana, which would in turn depress daily fees.

Despite being extremely cheap compared to Ethereum, the Solana blockchain collects millions of dollars in fees every day thanks to the sheer magnitude of meme coin trading activity on the network.

Still, the fee difference isn’t a big one. Blockchain activity on Ethereum netted it over $1.84 million in the past 24 hours, while it was nearly $1.2 million for Solana, DefiLlama data shows.

Pump.Fun has since come back online, and is seeing thousands of new memes launched daily as usual. Peruse it at your risk.